Working Capital 201: Profit vs. Cash Flow Drivers

Ever feel like your business is profitable, but you’re still struggling to pay bills and cover day-to-day expenses?

Today we’ll build on the Working Capital 101 concepts we covered last week and drill deeper into the differences between profit and cash flow.

Remember: Profit does not equal cash flow

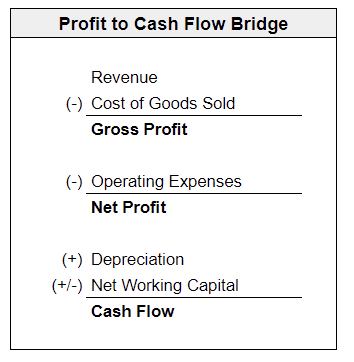

Here’s a basic formula/visual walking from revenue down to profit and then to cash flow:

You’ll notice 2 key items influencing the profit to cash flow equation (there are other factors but those are more advanced concepts):

- Depreciation

- Net working capital (NWC)

Depreciation is pretty straightforward. You’ve already purchased that big-ticket piece of equipment, depreciation is the non-cash expense recorded over its useful life. Add it back to profit.

Net working capital (NWC) is a bit trickier. NWC is made up of changes in the following balance sheet accounts:

- Receivables – if A/R increases, cash decreases – you haven’t collected on those sales yet

- Inventory – if inventory increases, then cash decreases – you purchased stuff that hasn’t sold yet

- Payables – if A/P decreases, then cash decreases – you’ve paid what you owe to suppliers

- Credit cards – if credit cards decrease, then cash decreases – you’ve paid down your balance

You’ll notice the assets move opposite with cash (receivables/inventory) while liabilities move in-line with cash (payables/credit cards). That’s the main takeaway here. By the way, that relationship with cash holds true for any asset or liability account.

This flow from profit to cash is called the indirect method of calculating cash flow. It’s a useful concept and it’s how accounting software like QuickBooks will show it to you.

Why should this matter to you?

You now have an understanding of the main drivers impacting cash flow which means you can pay closer attention to those balances. We’ve previously talked about using ratios and metrics to monitor these (thanks Module 2 of Profit Mastery!). Here are some questions to ask yourself with this information:

- Is inventory increasing at a faster rate than sales?

- How about A/R?

- Am I paying close enough attention to these balances?

- Is anyone at my company tracking these on a weekly, monthly, or quarterly basis?

(I’ve previously covered the direct method for calculating cash flow too. It’s more intuitive, but a bit extra work.)