What’s Your Neighbor Up To? (A Guide to Benchmarking)

Wouldn’t it be helpful to know the financial performance of other businesses with your exact same business model? It’s a surefire way to see if you’re leaving money on the table.

“I believe in the discipline of mastering the best that other people have ever figured out.” — Charlie Munger

What is benchmarking?

After completing a financial review, we can take those findings and compare them. There are several useful comparisons when benchmarking financials:

- We can compare them against time (history)

- We can compare them against peers or competitors

- We can compare them internally, such as stores, segments, or geographies

- We can compare them against a model, like a startup or franchise

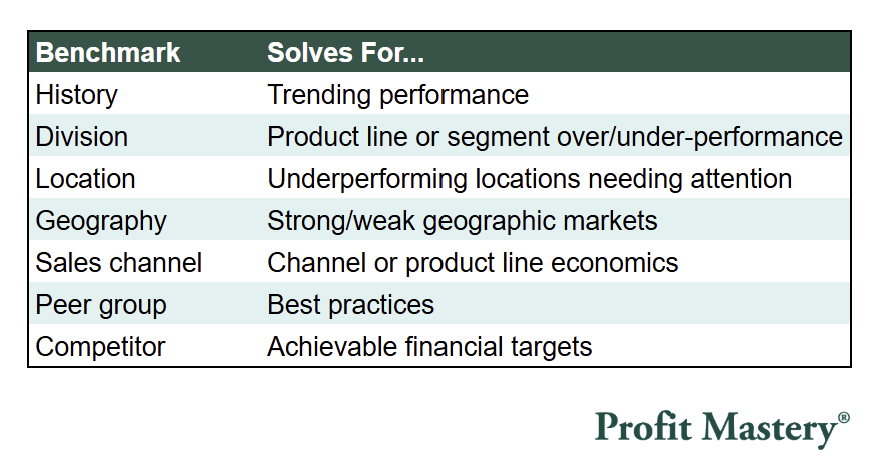

Each of these can be used to solve different business problems…

A benchmark is simply a comparison of one “thing” to another. That “thing” could be a metric, a ratio, a percentage, etc. If I’m running a retail business in Vermont, then I’d like to know how much metrics stack up against other retailers nationwide and other retailers in Vermont.

Why this matters…

Hopefully it’s obvious how powerful benchmarking can be. It gives us a reference point for something that otherwise has little value.

For example…

40% gross margins is just a number until we compare it to something. If gross margins historically were 50% and competitors are operating at 60%, then our 40% looks downright ugly…

…but there’s a beacon of light surrounding that darkness, because it tells us that the business model has the potential to support higher gross margins! Now we can build a plan to understand and then improve our margin structure.

If goals are a north star for your business, then benchmarking is the compass. The former is aspirational, but the latter is factual, which makes it perhaps the most valuable tool when setting financial targets.

When my partner and I got into the retail/apparel business, my business partner (with a very strong ops background) wanted us to aim for 15% operating margins. I told him retailers were lucky to get 10% and on average were earning 7-8%. This meant we would need to be best-in-class operators, bring it on.

How to do it…

The process is simple and intuitive. Executing is where things get challenging. Basic steps include:

- Complete financial review — you need ratios and metrics from your business

- Benchmark goals — which type of benchmark (internal, peer, competitor, model)

- Select your peer group — size, industry, geography, business model, etc.

- Gather data — using public and private sources, gather benchmark financial data

- Adjust and normalize figures — clean-up is a must; there could be accounting differences, time period mismatches, or one-off anomalies

- Exclude or investigate outlier data — consider this a reasonableness test; if you and 3 peers have 40% gross margins and a competitor benchmark is 80%, then it probably won’t be relevant without a better understanding

Much like I use ratios to dictate where to focus my financial attention, I’ll use benchmarks to guide me on what’s reasonable / unreasonable and where we should be pushing for improvement.