Unit Economics – Find Your Crown Jewel

Today we’ll cover a topic near-and-dear to every business owner – unit economics – we love thinking about how much we make on every sale!

What are Unit Economics?

Don’t be fooled by the fancy term… unit economics are simply the profits you earn on a per-unit, or per-service, basis (think: your margin on the sale of a single item).

I think about it more broadly as the margin or profit potential across every sales channel, product line, or customer segment. This is where things get interesting.

How it works / unit economics 101

Starting with the key terminology… to determine your unit economics you’ll need to know:

- Selling price – What you charge per unit or per service

- Variable costs – Costs that move inline with sales

- Fixed costs – Costs that remain flat, regardless of volume

- Contribution margin – Sales minus variable costs

- Breakeven point – Units sold OR sales dollars required to not lose money

The basic formula is simple:

Sales minus Variable Costs = Contribution Margin

Contribution margin is the main concept here, both in dollars and percentage. You need enough of it to cover your fixed costs. That will require a certain level of sales (or units sold) to achieve breakeven.

Why is this important?

Here are my favorite takeaways in using unit economics to help business owners:

- Find the margin – Remember my lessons from turnarounds? Every business inevitably has one product or service that’s far more profitable than the rest. Oftentimes it’s 4-5x more profitable than your next highest margin offering. Find it. It’s your crown jewel. Don’t discount your crown jewel too heavily or too often.

- Profit segmentation – A related concept to finding your margin: if you have a good understanding of profit by channel/product/customer, then you’ll open an entirely new world of management decisions –

- Negative margin customers? Cut ’em.

- Low margin product line? Raise prices (or at least don’t discount!)

- High margin channel? Focus all your marketing effort there.

- Product launches – Most business owners assume their offerings need to be homogenous with similar pricing and margin profiles. Nah. Instead, aim for a lower margin “gateway” product to get customers in the door and at least one very high margin premium offering or product line (white glove 1:1 services, limited edition / quantity product, etc.). The higher margin offering should be 4-5x more profitable than a gateway item.

- Sales & marketing – When it comes to promotions and discounts, do you really know how much room you have? This would certainly be a good place to start. Don’t offer 20% off when you only have a 10% contribution margin (unless you know what you’re doing!).

How to use this

Let’s put this into practice and see how it works.

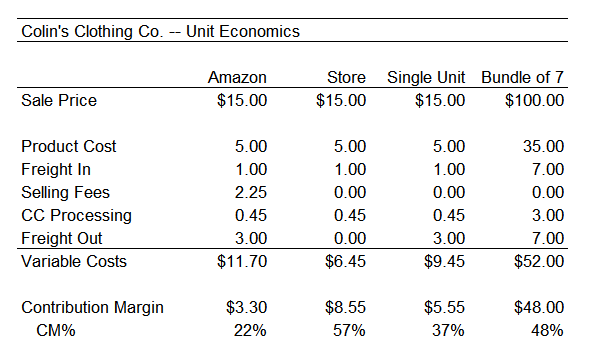

Say I run a clothing business, Colin’s Clothing Co., selling t-shirts for $15/unit on Amazon and in a retail store. Many of my customers are interested in buying in bulk for a discount so I decide to sell a pack of 7 at $100 (a $5 discount from buying 7 single units).

Here are my unit economics by channel (Amazon vs. storefront) and by product line (single pack vs. bundled):

My new bundle is >5x more profitable than my next highest contributor (a single unit sold in store). This looks like a promising new product for me to focus on. Notice any other glaring differences between my channels and products? Tons of useful information here.