Building Good Financial Processes

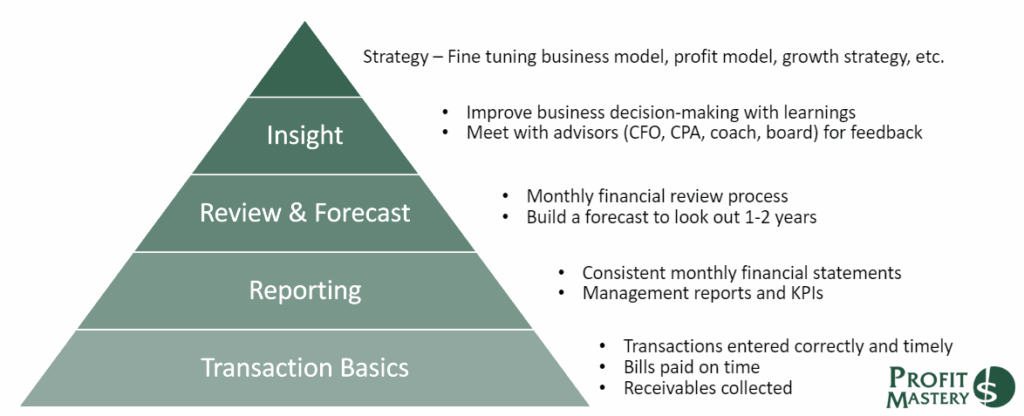

There’s a hierarchy to a well-oiled financial system:

- Start with the foundation — good accounting, clean books, and smooth handling of the regular transactions (bills, invoices, payroll, etc.).

- From there move up to reporting — financial reports, management reports, KPIs, and other advanced tools (like break-even, TTM analysis, etc.).

- The next leg up is the monthly review and forecast — take the information you’ve gathered in steps 1 & 2 and set aside time to interpret it each month (review); then make a prediction as to what comes next (forecast)

- Now we’re analyzing and looking for insights — this is a good place to get some outside help for a fresh set of eyes… in this phase, we’re looking to steer the ship and make better business decisions with the numbers at hand

- Big picture thinking — only until we have all other layers of the pyramid functioning should we evaluate larger strategic moves; things like acquisitions, new geographies, new product lines, business model pivots, etc.

Here’s what that hierarchy looks like visually:

What’s the takeaway?

If you don’t have good bookkeeping — start there; find an excellent partner. If you have good books and regular reports — consider a fractional CFO or advisor. The ROI on those 2 items will shock you.