Understanding Labor Costs

Looking at Labor Dollars

Some common things I’ve heard when it comes to managing the financial side of labor costs:

- Our team is highly efficient

- That person isn’t fully utilized yet

- We’re adding headcount at a very fast pace

- This technology will reduce our staffing needs

- We have a productivity issue in that department

Most of these are anecdotes, and that’s how I see most companies running their business from a labor cost standpoint.

We’re hosting a webinar for members next week covering labor efficiency (save your spot below). So consider this a primer for that session.

1) Direct vs. Indirect

Most financials lump payroll into a single account on the P&L. This is a huge missed opportunity for a quick pulse on productivity.

Start by separating direct and indirect labor on your P&L. Keep those direct labor costs in the cost of goods sold (COGS) section too. What are these?

- Direct — These wages physically make or deliver your product. In a service business, they are technicians, service providers, etc. and work directly with clients. In a product business, they likely work in a warehouse or factory.

- Indirect — Management, admin, supervisors, sales & marketing, and overhead operations people fall into this bucket. Both product and service companies have indirect (overhead) labor.

2) Salary vs. Hourly

Next, we want to separate salaried vs. hourly wages. This doesn’t need to be reflected on your P&L so you might have a separate report looking at these each week, month, or quarter based on the size of your business.

- Salaried wages — Highly predictable and fixed in nature. It’s possible to have salaried direct and/or indirect labor too. These costs are rigid and harder to flex up or down as revenue grows or declines.

- Hourly wages — Variable in nature. In theory, you can create a schedule for hourly wages and keep them closely tied to revenue.

3) Departmental Wages

Last, you’ll want to divide your wages up by department. This is completely optional and dependent on your business, industry, and size. Example: if you have total indirect headcount of 2 people, then you probably don’t need to divide those into departments.

Some examples for departmental wages: sales, marketing, management, office, customer service, production, retail, staff, finance, accounting, warehouse, etc.

As you grow, these are better tracked as a subgroup on your P&L.

4) Metrics for measuring

There are 3 excellent ways for tracking labor efficiency and they work in any business at any size.

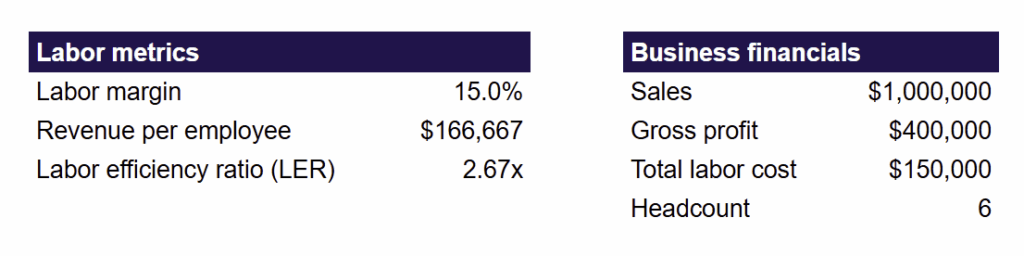

- Labor margin — Take your labor costs and divided them by revenue [labor cost ÷ revenue]. Also known as labor as a % of sales. We can do this for direct labor, indirect labor, or both combined.

- Revenue per employee — Take revenue and divide by headcount [revenue ÷ headcount]. This is very easy to calculate and track over time. Its biggest benefit is the simplicity, you don’t need highly accurate financial reporting to know your revenue and headcount.

- Labor Efficiency Ratio (LER) — Take your gross profit (excluding all labor costs) and divide it by total labor cost [gross profit ÷ labor cost]. Think of it as gross profit per labor dollar (i.e. a 2.0x LER = $2 of gross profit for every $1 of wages). If your books are accurate, this is much more powerful than labor margin.

As with any metric, we can do a lot with these… we can track them over time for trend analysis; or we can compare them to a benchmark or peer group.