7 Types of Pricing Power

Pricing Power

What comes to mind when you hear the phrase: “raise your prices”?

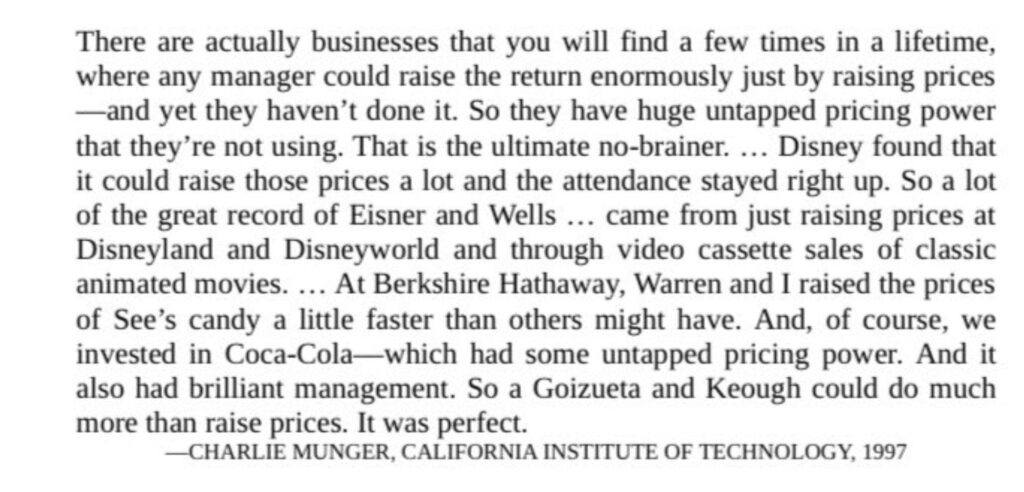

Pricing will always be the fastest path to profitability. Full stop. The trick is getting it right. Before we unpack what goes into it, let me share this Charlie Munger quote on the concept of “pricing power” in business.

Buffett and Munger spent their careers searching for businesses with a “moat” (competitive advantages + long-term pricing power). And they had a unique ability to look out 5-10 years ahead to make sure those attributes would stick.

Pricing power was a huge component of their “moat” concept. If it matters this much to them, then it should matter twice as much to you.

7 types of pricing…

There are different ways to price your products and services (revenue models as I call them). Think of this as how you charge for your service or product offerings. Some examples include:

- Keystone — This is a simple approach used in retail where the retailer doubles their wholesale cost to the customer (i.e. a 2x mark-up over cost). The clothing store at the mall might pay $10 for the shirt on the rack and charge $20 to the customer.

- Cost-plus — Charging a predefined mark-up (or margin) over the cost of the product. A great model for distributors or other commodity-driven industries. If the cost for your product swings significantly, then a cost-plus model might work best.

- Tier-based — Have you ever seen a “bronze, silver, gold” offering package? That’s tier-based. You can bet that company is making a lot more margin on the gold tier than the bronze tier.

- Fixed price — An “all-inclusive” price for the work performed. Common in professional services (i.e. $1,000 per month for bookkeeping), but also in service work (a landscaper might quote a $10,000 fixed price for a backyard project).

- Value-based — Price is tied to the value delivered to the customer. Common in consulting engagements; for example: let’s say I work with you to increase annual profits by $200,000, you’re probably willing to pay a percentage of that if I can deliver.

- Usage-based — Price increases based on usage of the product. Common in software where the more you use an app/service, the more you pay for it.

- Time & materials — Actual labor hours at a set rate + direct material costs as a pass-through. Common in service businesses or project-based companies with unknown or unpredictable workloads.

This isn’t an exhaustive list, but you get the picture: there are many different ways to determine pricing for your offerings. And these have a profound impact on your bottom line.

So how can you use this?

Ask yourself where you can create pricing power in your business.

Sure, not every business/industry can take annual price increases without regard to cost. But there is always a subset of your company where pricing is flexible and margins are higher.

The first thing I would do is look at my competitors to see which pricing model(s) are being used. Then, I’d compare my prices and offerings to the industry. Don’t limit yourself to your geographic area

Next, I’d look at the offerings in my portfolio and ask where I can add enough value to command premium prices (and therefore premium margins).

Last, start connecting businesses you see in everyday life to the list of pricing models above. How can you use aspects from another industry’s model in your company? This process can set you apart from competitors.